What is The True ROI of Events and When It's Realized?

There is much more than 'return on investment' involved.

In connection with and a good reminder of everything we have discussed so far:

We organically land on the topic of ROI (return on investment) and its very complex flow.

The first thing we’ll do will be transform ROI into RCE: Real Cost of Everything. Why? Because in the world of events (but not limited to), to understand your return on investment, you first need to understand the actual costs: Both tangible and intangible! Both short-term and long-term!

Projects vs. Benefits

Every event is a PROJECT, and like any project, it follows a predictable trajectory. To give a very obvious example, an enterprise-focused event (project) might take six months to prepare and last for a week, but the benefits (sales from leads, partnerships formed) might not peak until two years later.

Every event is a project, and like any project, it follows a predictable trajectory:

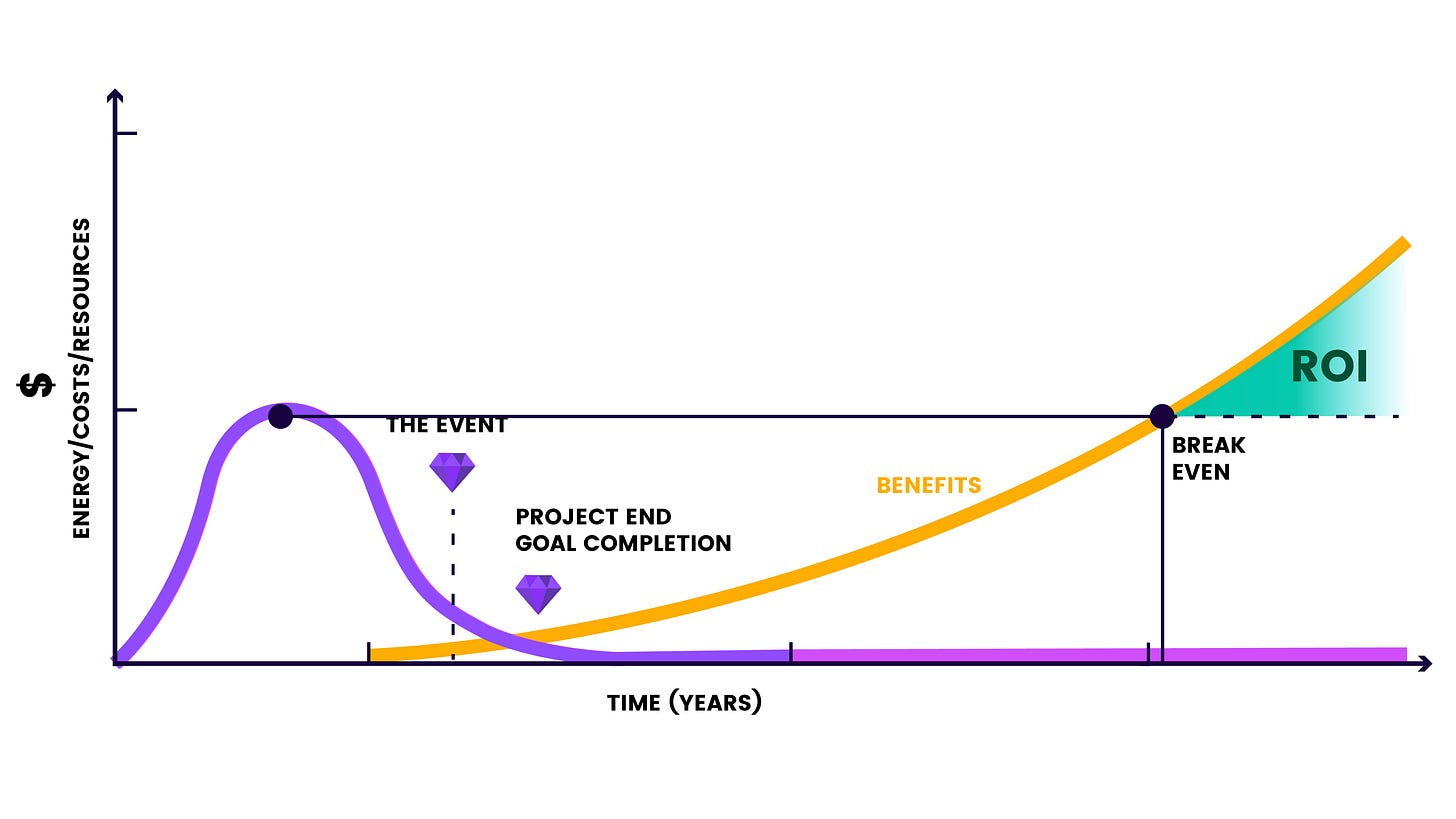

The Project Bell Curve: At the beginning, there’s a sharp incline of effort, resources, and costs as the event is conceptualized and prepared. Time, energy, and money pour in during the planning phase. As the event nears, the intensity peaks, followed by a steep decline as the event concludes, deliverables are finalized, and the project is closed.

The Benefits Bell Curve: Unlike the project curve, the benefits curve often starts flat and lags behind the event itself.

Real returns begin to materialize only after weeks, months, or even years. This is where most organizations underestimate the ROI timeline.

Tangible vs. Intangible Costs

One of the biggest challenges in event planning is identifying and calculating all costs associated with the project. These costs can be divided into two categories:

Tangible Costs:

Booth or sponsorship packages (e.g., $40,000 to $100,000+, depending on the booth tier)

Travel expenses (flights, accommodation, daily allowances)

Marketing materials (banners, printed brochures, swag)

Vendor invoices (catering, tech equipment rentals, artists, or additional marketing/tech help for your booth)

Intangible Costs:

Employee hours spent on planning and attending the event, including overtime (we understand the paid overtime, but what about the overtime team members willingly put into the project without reporting any hours?) - commonly known as Cost of Sales.

Additional platforms used, that support the project, like Atlassian Stack, Bitly, LI Professional, and so many more - also part of your Cost of Sales.

Opportunity costs of pulling team members away from other priorities.

The hidden toll on productivity due to event fatigue, post-event follow-ups, and ongoing lead nurturing.

The hours that are done by Sales Teams for many months or even years, to drive new deals over the line.

Here’s an illustrative example:

A marketing team attends a significant trade show with an official budget of $65,000. However, accounting for all the intangible costs (e.g., time spent by a team of 10 over three months, follow-ups, and travel fatigue), the total investment might easily climb to $150,000.

When is ROI Realized?

Very few people are going to want to align the goals of Event Projects to the “Noisy Marketing” or “Networking” approaches, we discussed in the previous blogs.

Most people want $$ results, and the key takeaway is that ROI is NOT realized with the end of your event. Or even the weeks or months that follow.

For events focused on enterprise sales, follow-up cycles can stretch into years.

To truly measure success, first answer these questions:

How many leads were captured?

How many deals were closed?

What’s the total revenue directly tied to the event?

Did the event strengthen brand awareness?

Were valuable relationships formed?

Was the team energized or drained by the experience?

Use the answers as your event retrospective and save it as a data source. Then, schedule check-ins at regular intervals (e.g., three months, six months, one year) to evaluate your ROI progress. For example, if a $150,000 investment brings in $500,000 in revenue over two years, the ROI story only becomes clear when viewed on a long-term timeline.

Once you have done this, you will have one of the most crucial tools your company will ever need: The Benefits Review Plan.

Fun Inc at Atlas Camp, what was our return on investment?

A very easy practical example is Andy’s trip to Atlas Camp, where he approached the event both as a participant and evaluator of ROI.

By calculating and documenting both tangible and intangible costs, we discovered how our initial investment ballooned with added travel time, preparation hours, onsite changes of schedule, and ongoing follow-ups. Conversations with leads didn’t end at the event but transformed into projects that could last several months.

Moreover, the intangible benefits, like deepened partnerships and new cultural insights from our conversations, highlighted the broader value of attending. While immediate KPIs were met, the full ROI will continue to unfold as leads turn into clients and collaborations into business opportunities.

Why does this read feel like a cold shower?

If you’re not carefully calculating all your costs and considering the delayed benefits curve, you’re likely underestimating the true investment required for events. This can drive false expectations or diminish the efforts already made by the team.

By understanding the real and hidden costs, businesses can set realistic KPIs and ROI expectations, break silos between marketing, sales, and operations, and maximize the long-term benefits of their event investments.

Also, some people might look at event and say, “Well, we only sponsor due to the strategic relationship we maintain with the host. There is no real ROI on our event, and it’s just regular ‘Cost of Sales’”.

However, Fun Man says:

“Au contraire, mes amis! You can literal measure all of that strategic engagement, especially the outcomes, and, if you are not seeing the kind of ARR Growth that was defined as part of the initial Strategic KPIs on the SLT, then you are not achieving ROI on that strategic relationship.

Key Takeaways

Events are about more than the immediate buzz. They’re long-term investments in relationships, brand credibility, and strategic growth.

So, the next time you budget for an event, consider the bell curves, factor in the hidden costs, and prepare to track ROI for the long haul. True success lies in the benefits that outlast the confetti. 🤓 🎉

Fun Fact: Andy hates Confetti. Shocker, right?

Fun Inc helps companies better understand and improve their approach to networking, events, sales, and long-term business relationships. Interested to learn more?

In our next (and final) blog from the eventing series, we discuss AMOs, Additional Marketing Opportunities, and whether they are a good investment for your event or just a waste of resources.

For the record, our ROI from Atlas Camp is about to be fully realised within 6 weeks of the event.